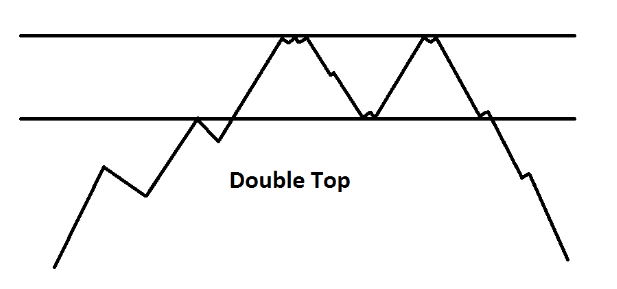

Double and Triple Tops

Technical Analysis > Basics of Chart Patterns

A double top is a scenario where the price reaches a high twice before falling significantly from then. The price is unable to break above the previous high. This is interpreted as a sign of weakness. Often times, the second high or peak is lower than the previous peak. This is a major sign that the price of the security will fall significantly.

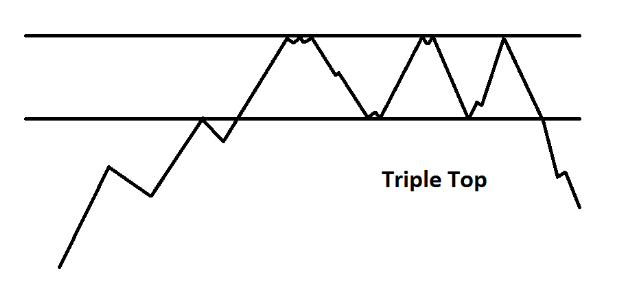

A triple top has 3 peaks, with each peak lower than the prior peak, and unable to break above the previous peak. There is significant price weakness as in the case in a double top. The price of the security falls thereafter.

Read:

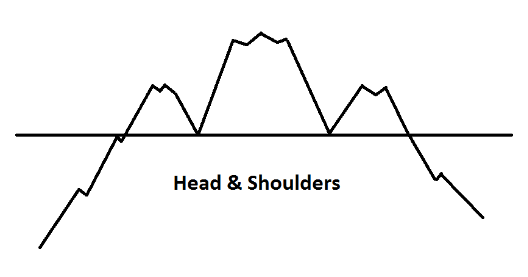

Head and shoulders

Reverse head and shoulders