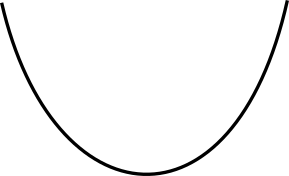

Because everyone needs to keep their options open :)

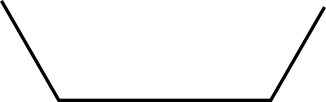

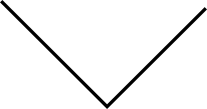

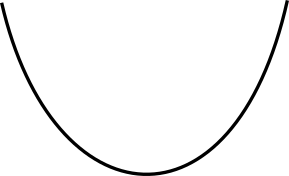

Firstly, there are two types of options. You have call options and you have put options. In both cases of put and call options, the holder of the option, also known as the buyer of the option gives the holder(buyer) the right but not the obligation to buy or sell shares of the underlying securities at a specified price on or before a specified date...

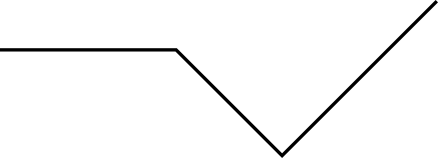

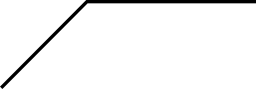

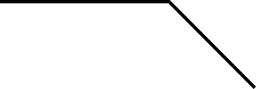

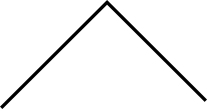

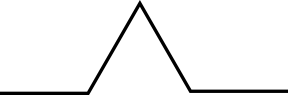

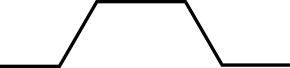

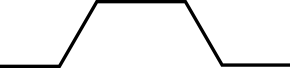

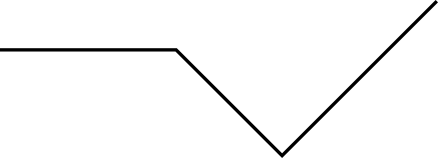

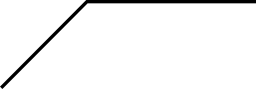

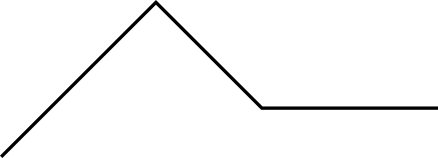

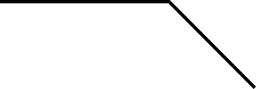

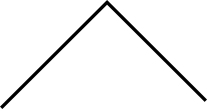

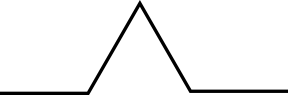

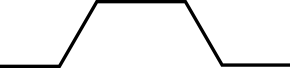

A call option is an options contract that allows the holder, also known as the buyer, the right to buy 100 shares of the underlying asset at a specific price( the strike price) on or before a specific date. The buyer of the call option has the right but not the obligation to buy the underlying asset....

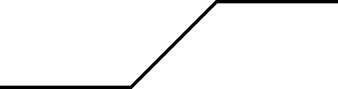

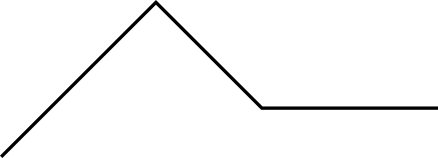

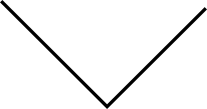

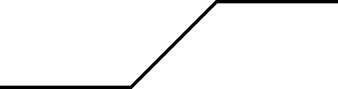

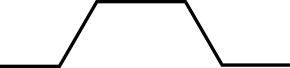

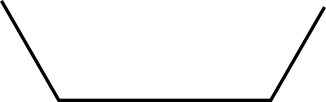

A put option is a contract that gives the owner of the contract the right but not the obligation to sell a certain number of shares before or on expiration date. The put option owner is the buyer of the option contract and is also known as the holder of the options contract...