| Market Outlook | Strategy | Payoff Graph |

|---|---|---|

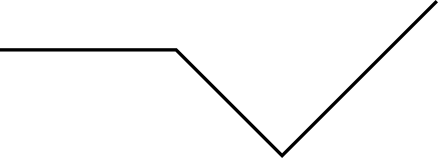

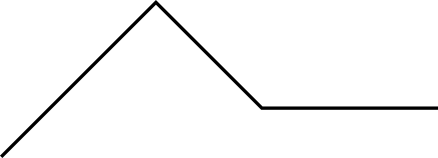

| Very Bullish | Call Ratio Backspread |  |

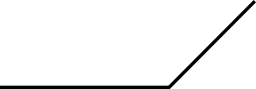

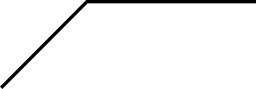

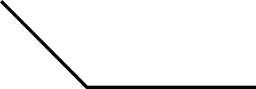

| Bullish | Long Call |  |

| Bullish | Short Put |  |

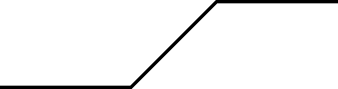

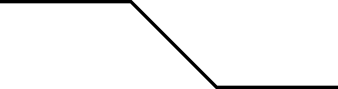

| Bullish | Bull Call Spread |  |

| Bullish/Stable | Put Ratio Spread |  |

| Moderately Bullish | Bull Put Spread |  |

| Slightly Bullish to Neutral | Covered Call |  |

| Very Bearish | Put Ratio Backspread |  |

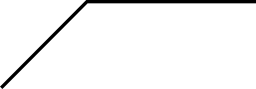

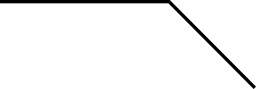

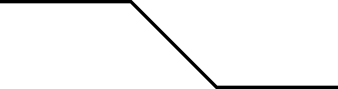

| Bearish | Short Call |  |

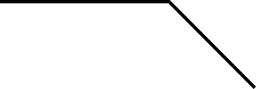

| Bearish | Long Put |  |

| Bearish | Bear Put Spread |  |

| Bearish/Stable | Call Ratio Spread |  |

| Moderately Bearish | Bear Call Spread |  |

| Slightly Bearish to Neutral | Covered Put |  |

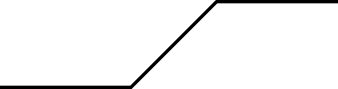

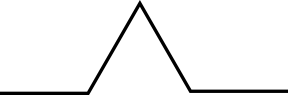

| Stable | Short Straddle |  |

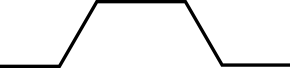

| Stable | Long Butterfly |  |

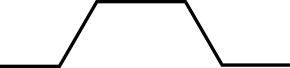

| Stable | Long Condor |  |

| Stable | Long Iron Butterfly |  |

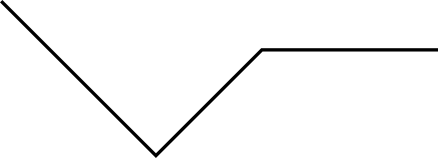

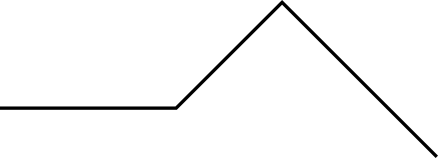

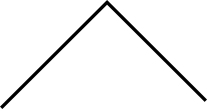

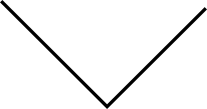

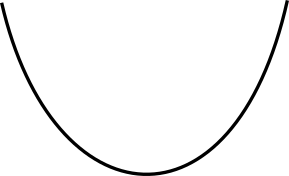

| Volatile | Long Straddle |  |

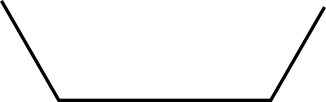

| Volatile | Long Strangle |  |

| Volatile | Long Synthetic Straddle |  |